Pradhan Mantri Awas Yojana (PMAY) – Made Simple

Last Updated on, December 5th, 2022

With the introduction of the Pradhan Mantri Awas Yojana Scheme last year, a lot has been written about it. All real estate players are advertising it. All bankers are offering it. But for a first time home buyer all of it might seem a bit too overwhelming. At Marathon, we consider us, your partner in the home buying process. We’ve tried to explain the whole process as simply as possible. This will give you a clear idea of what is PMAY and how you can go about to apply for the same.

What is PMAY?

The Pradhan Mantri Awas Yojana (PMAY) is a government scheme to help promote “Housing for all by 2022”. It aims to assist first time home buyers and encourage women to become home owners by providing an interest subsidy on home loans. PMAY brings into fold a Credit Linked Subsidy Scheme (CLSS) for home loans in the urban property market.

Who is eligible under PMAY?

The scheme is aimed to provide primary housing for all. The basic eligibility rules, in order to avail PMAY benefits are as follows.

- The applicant’s family* income should not be above Rs.18 lakh per annum

- The maximum RERA carpet area eligible for the subsidy is 200 sqm

- The applicant’s family must not own a house in any part of the country.

- In the case of a married couple, either a single or a joint ownership deal is allowed, and both options will receive just one subsidy.

- The applicant’s family must not have availed the benefit of any housing-related schemes set up by the Government of India.

How does PMAY work?

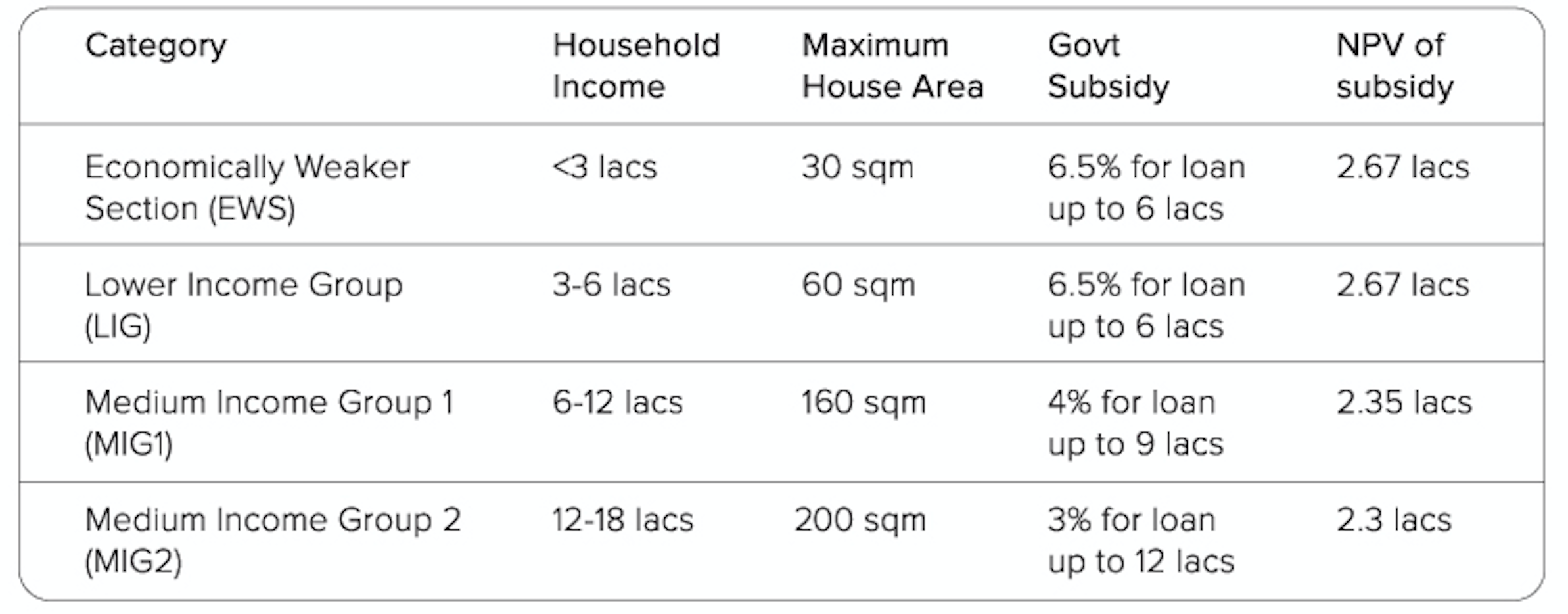

There are 4 broad categories of the CLSS scheme under PMAY. The categories, and the loan eligibility & subsidy across these categories have been explained in the table below**.

T & C * Deadline of the scheme for EWS – LIG is March 2022 And MIG 1 – MIG2 is March 2021

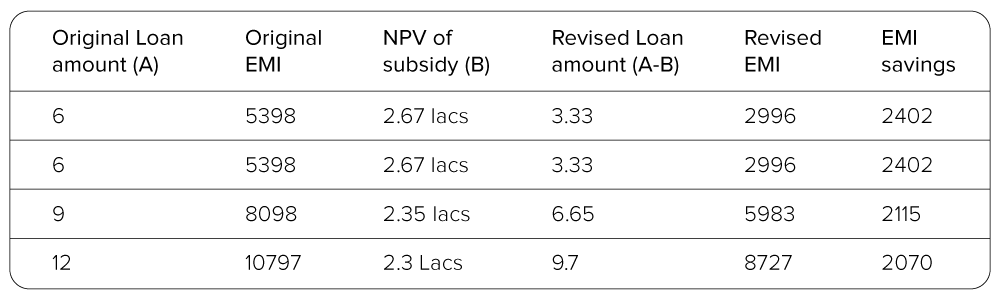

Rest is simple. Whoever is availing the PMAY subsidy under a particular category, gets the subsidy amount directly deducted from the overall loan amount. This reduces the overall EMI burden. The savings in terms of EMI has been highlighted in the table below.

How to avail the PMAY subsidy?

PMAY linked loans can be availed from any primary lending institutions (PLI) such as scheduled commercial banks, housing finance companies, cooperative banks, etc. Housing Development Corporation (HUDCO) and National Housing Bank (NHB) have been identified as the Central Nodal Agencies (CNAs) to channelize this subsidy to the lending institutions. The process has been highlighted in the flowchart below

-

Home Loan application by individual to the PLI

-

Determination of loan amount and sanction of loan subsidy based on eligibility

-

Claim submission by PLI to CNA

-

Claim approval and release of subsidy amount by CNA to PLI

-

Credit linked subsidy deposited by PLI in the beneficiary’s loan account

Our projects are approved for funding by various leading banks. Our bankers are available on site to assist you with the PMAY subsidy and your home loan.

Our PMAY Eligible Projects

At Marathon, we have a rich history of 50 years in which we’ve successfully delivered 80+ projects of all kinds – from homes in standalone towers, skyscrapers and townships, to large offices, retail shops and small business spaces. We currently have four township projects in the fastest growing parts of the city which are eligible under PMAY guidelines.

Marathon Nextown

Nextown is a meticulously designed township in Dombivli, offers 1, 2 & 2.5 BHK homes with a classic European architecture, superb floor plans, incredible views & world-class amenities.

Marathon Nexzone

Nexzone is our flagship township in Panvel has 12 well-designed towers, overlooking the majestic Matheran hills and a host of world class amenities offering 1, 2 & 2.5 BHK homes.

Marathon Nexworld

Marathon Nexworld is a revolutionary new mega-township in Dombivli with stunning 1 & 2 BHK apartments.

Marathon Neohomes

NeoHomes are smartly designed homes in superb skyscrapers with efficient apartments that let you do more with less. Studio & 1 BHK apartments in Bhandup.

Marathon Nextown

Nextown is a meticulously designed township in Dombivli, offers 1, 2 & 2.5 BHK homes with a classic European architecture, superb floor plans, incredible views & world-class amenities.

Marathon Nexzone

Nexzone is our flagship township in Panvel has 12 well-designed towers, overlooking the majestic Matheran hills and a host of world class amenities offering 1, 2 & 2.5 BHK homes.

Marathon Nexworld

Marathon Nexworld is a revolutionary new mega-township in Dombivli with stunning 1 & 2 BHK apartments.

Marathon Neohomes

NeoHomes are smartly designed homes in superb skyscrapers with efficient apartments that let you do more with less. Studio & 1 BHK apartments in Bhandup.

*Applicant’s family comprises of husband, wife, unmarried sons and/or unmarried daughters.

**For the NPV calculation the time period under consideration is 20 years or actual tenor of the loan, whichever is lower. The savings highlighted in this booklet are based on the current rules set by Govt. of India, which may change as per the directive of the Government. Please get in touch with our bankers at the site for additional details on eligibility and application process.

This document is informational only and is based on data as available on the date of printing. Marathon Group does not bear any responsibility for the accuracy of the information in the document. Buyers are requested to check their eligibility and other details of the scheme with their bankers.