How to Pay TDS For Property Purchase Online?

Last Updated on, July 8th, 2024

When Is TDS Applicable on Property Purchase?

TDS on property purchase is applicable when the property sale is 50 lakh or more. The buyer of the property has to deposit the TDS to the Government. TDS has to be deposited with the Government within 30 days from the end of the month in which the deduction is made. Under Section 194-IA, 1% TDS is applicable on property if the sale value of the property exceeds 50 lakh.

For example, if you buy a property worth 80 lakh, the TDS has to be deducted from the entire amount – that is Rs 80 lakh, not Rs 50 lakh or 30 lakh which exceeds the Rs 50 lakh threshold.

Step-by-Step Process to Pay TDS Online

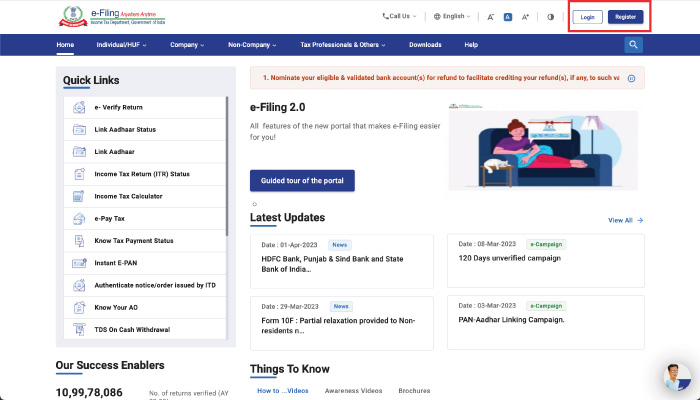

Step 1 – Open the Official Website of the Income Tax Department

Go to the official website of the income tax department –https://www.incometax.gov.in/iec/foportal/

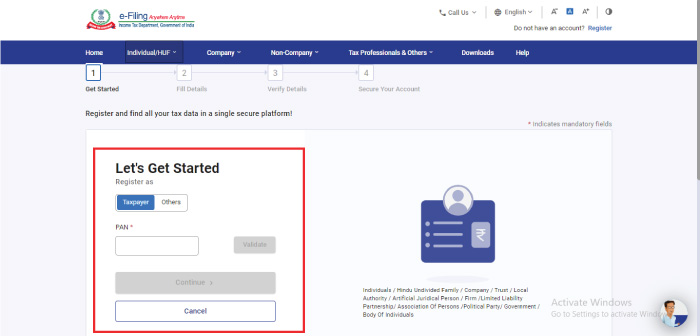

Step 2 – Register your account

In case you do not have a login ID, please register through your PAN number and generate a password for further login.

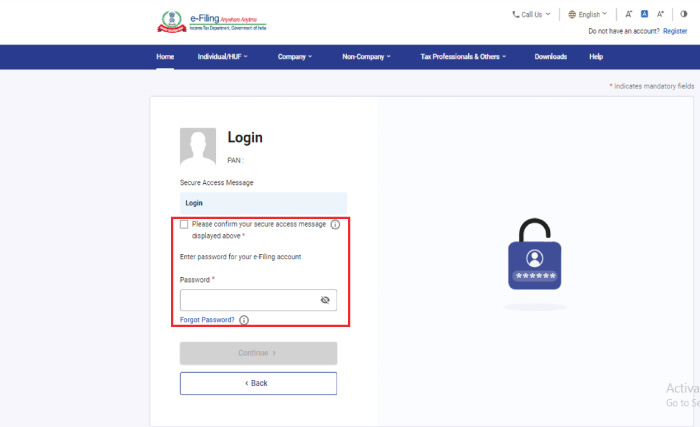

Step 3 – Login to your account

Login with your PAN number as a user ID and continue. Click on “Please confirm your secure access message displayed above” and “Continue” to log in to the portal.

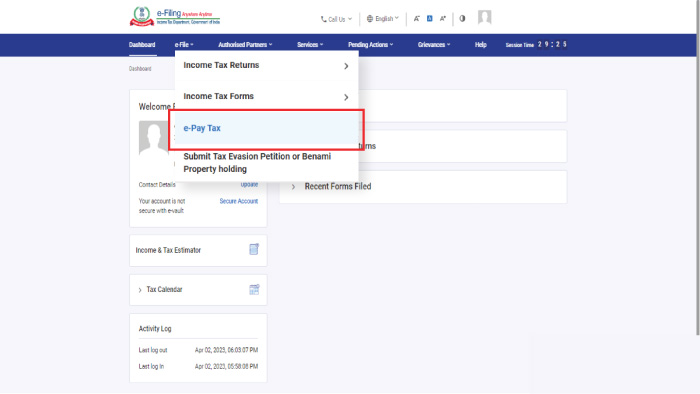

Step 4 – Select e-Pay Tax

Go to the “e-file” section and select “e-Pay Tax” from the dropdown menu.

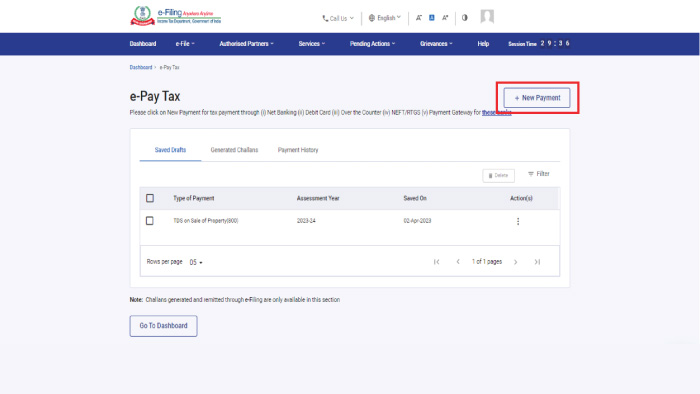

Step 5 – Select New Payment

Once that section loads, click on the “New Payment” button on the right side.

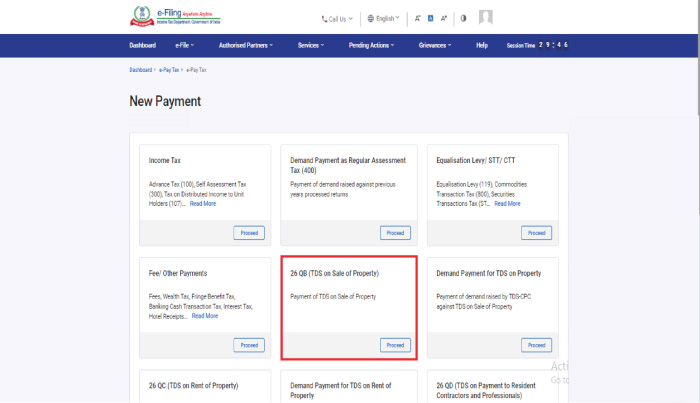

Step 6 – Select TDS on the Sale of the Property

Select “26 QB (TDS on Sale of Property) and proceed.

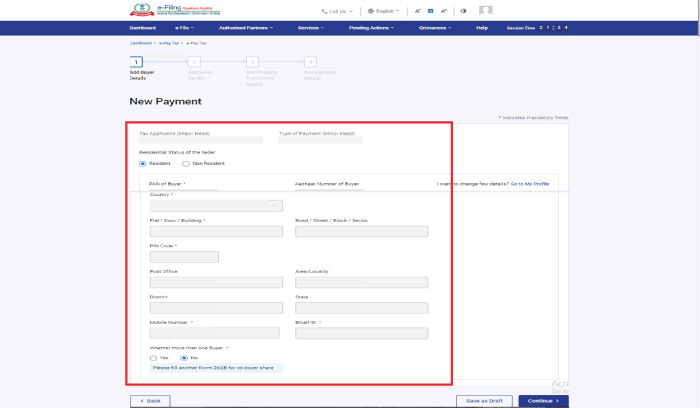

Step 7 – Fill in the Buyer Details

In the residential status of the buyer – Select “resident”. Fill in your (buyer’s) details such as your name, PAN number, address, mobile number, and email ID. In case there are multiple buyers, please select “YES”.

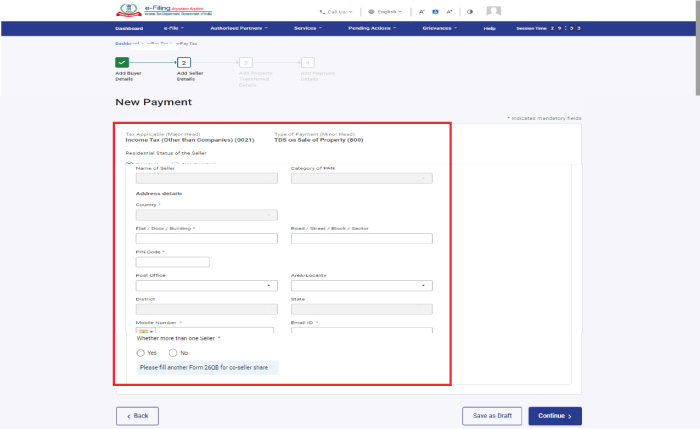

Step 8 – Fill in the Seller Details

Fill in the seller’s details such as the PAN number of the builder, address of the builder, mobile number and email ID. You can refer to our demand letter for all these details about Marathon. Select “No” to answer the question about “Whether more than one seller”

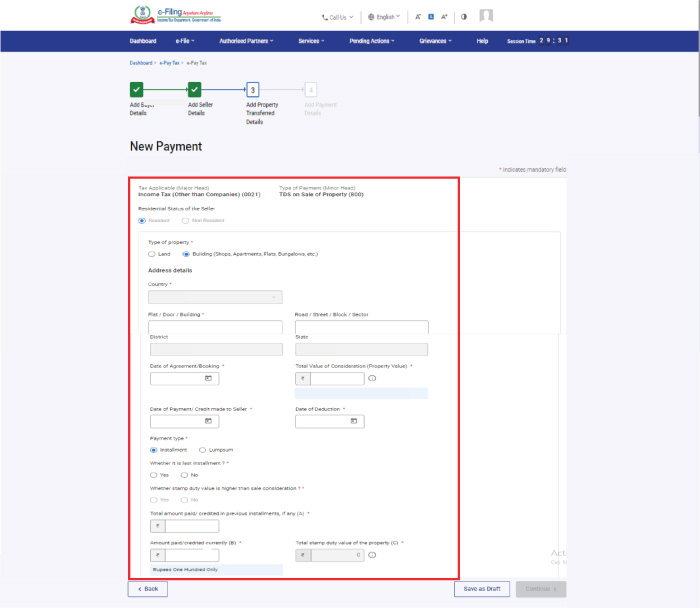

Step 9 – Fill in the Property & Payment Details

As a next step, you will have to enter the address of the property, agreement value, date of booking, date of payment, method of payment (instalment or lump sum), total amount paid in previous instalments and currently paid principal.

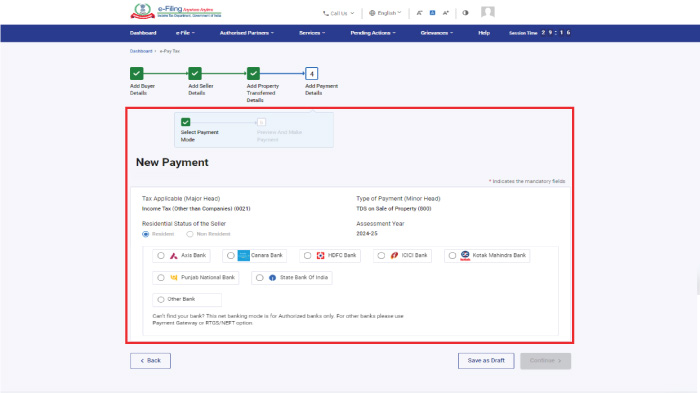

Step 10 – Select Payment Options

In the next step, select your payment option from a list of options displayed and proceed to the payment gateway.

Step 11 – Send us the TDS Receipt

Once you have made the payment, you will get a TDS receipt. You can email this TDS receipt to [email protected] or Whatsapp us at 7677350350.

Benefits of Paying TDS Online

Convenience

Online payment of TDS eliminates the need to visit tax offices in person. This method saves time as you can avoid long queues and eliminate paperwork.

Quick & Efficient

You can get instant confirmation when you pay TDS online. The payments are processed faster, expediting the overall process.

Reduced Errors

Online forms have built-in checks to prevent mistakes.

Better Record Keeping

When you pay TDS online, you get easy access to your payment history and receipts which can be invaluable for future references.

How to Pay TDS If There Are 2 Buyers?

In case of joint ownership, here’s the process you need to follow:

• Calculate the total TDS amount on property transactions.

• Divide the TDS amount as per the mutually agreed proportion.

• Both buyers can fill out form 26 QB.

• Make payment as per the amount divided.

• Download the acknowledgement receipt for records.

• Inform the seller about the TDS deduction by submitting the receipt.

Consequences of Delaying Payment on Purchase of Property

Interest Penalty

If you do not pay TDS within the due date, you may have to pay interest at the rate of 1% per month or a part of the month from the deduction date till the date of payment.

Late Fee

If the TDS payment is delayed, the buyer must also pay a daily late fee of Rs 200 each day for delay in submitting Form 26QB.

Penalty

The income tax department may also impose a fine of Rs 10,000- 1,00,000 on the buyer for delaying TDS payment under Section 271H of the Income Tax Act. However, this penalty can be avoided if the buyer pays the TDS, interest, and late fee before the expiry of one year from the due date of filing Form 26QB.