First Time Home Buyer Benefits & Schemes in India

Last Updated on, November 21st, 2024

Homeownership is more than just a place to reside, it’s a deep emotion. It’s that satisfactory feeling of pride and being financially secure. In India, various benefits have been crafted specifically for first-time home buyers to make this significant financial decision more feasible and budget-friendly. This blog will dive deep into the first-time home buyer government schemes, tax benefits for first-time homebuyers, essential tips for first-time homebuyers and much more.

Who is a first-time homebuyer?

Before we cover the benefits for first-time homebuyers, it’s crucial to understand the eligibility criteria of a first-time homebuyer or who qualifies as a first-time homebuyer:

• A person who hasn’t owned their main home in the last three years.

• Someone who has never owned a home, even if their spouse has.

• A single parent who co-owns a home with a joint mortgage.

• A person who only owned a home together with a spouse.

First-Time Home Buyer Tax Benefits

Section 80C

First-time homebuyers can claim a tax deduction of up to 1.5L under section 80C. This deduction can be claimed on the principal repayment of a home loan.

Section 24 (b)

You can claim interest deductions on your home loans, for up to a limit of 2 lakhs.

Section 80EE and Section 80EEA

Apart from the tax benefits under section 24, buyers can also avail tax benefit of INR 50,000 on interest repayment. This is over and above the tax benefits offered under Section 24.

Section 80EEA was introduced in the Union Budget 2019 only for first-time homebuyers who buy affordable housing projects. As per this section, homebuyers can get tax benefits on interest repayment upto INR 1.5L if the property is under affordable housing, i.e. – the value of the property purchased should be less than INR 45 lakhs.

The benefit of this deduction under Section 80EEA is valid only for 5 years starting from the year in which the loan was sanctioned.

GST Benefits for First-Time Home Buyers

In India, GST only applies when you purchase an under-construction property. To boost affordable housing and make property buying accessible for first-time home buyers, the Government has reduced GST rates.

Below are the GST rates on flat purchases:

GST payable is only 1% without input tax credit for affordable housing projects. For other projects, the GST rate is 5% without input tax credit for non-affordable housing projects.

Pradhan Mantri Awas Yojana

The Indian Government launched the Pradhan Mantri Awas Yojana Scheme in 2015 to encourage “Housing for All”. PMAY is a credit-linked subsidy scheme. Under PMAY, beneficiaries can get an interest subsidy on home loans. This scheme is exclusively for first time home buyers.

This scheme caters to home buyers from the Economically Weaker Sections (EWS), Lower Income Group (LIG) and Middle Income Group (MIG) of society. Under the scheme, potential homebuyers from these sections can avail of a tax subsidy offered on home loans.

The first-time homebuyer home loan grant is as follows:

| Income Group | Limit of Loan Grant | Income Eligibility | Subsidy |

|---|---|---|---|

| Economically Weaker Section (EWS) | Upto 6 lakhs | Must have annual income upto 3 lakhs | 6.5% |

| Lower Income Group | Upto 9 lakhs | Must have annual income upto 6 lakhs | 4% |

| Middle Income Group | Upto 12 lakhs | Must have annual income upto 12 lakhs | 3% |

Financial Growth

Homeownership is often seen as a cornerstone of personal financial growth. As you pay down your mortgage, you build equity in your property, which is a valuable financial resource. Furthermore, real estate typically appreciates over time, potentially increasing your home’s value and enhancing your net worth. This appreciation can provide substantial financial benefits if you decide to sell in the future, making homeownership a key strategy for long-term wealth accumulation. Additionally, owning property allows you to create generational wealth that can be passed down to future generations.

Stability & Security

Owning a home offers a consistent and secure place to live, which can be especially important for families or those planning for the future. When you own a home, you tend to reside for a longer duration in a community, fostering a sense of belonging. Additionally, having a fixed residence eliminates the uncertainty associated with renting, such as fluctuating rent prices and the possibility of eviction, thereby providing a more stable and controlled living environment.

Tips for First-Time Homebuyers

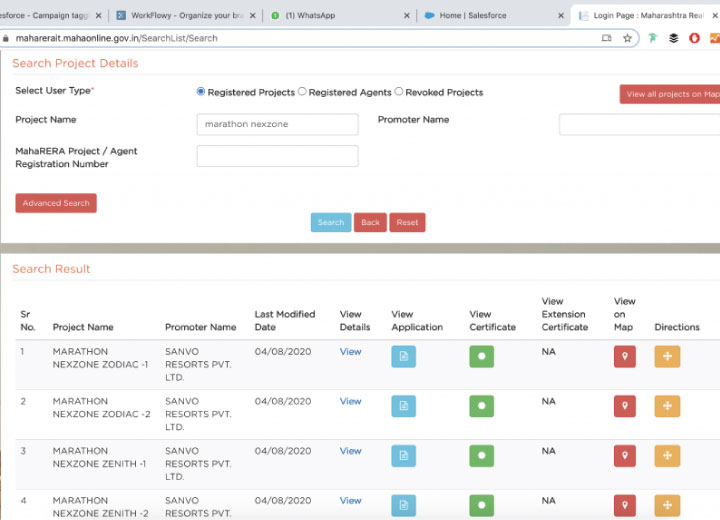

1. Check the RERA Details of the Property

When shortlisting any property, ensure it is registered under the Real Estate (Regulation and Development) Act (RERA) 2016. You can check all the RERA details of the under-construction property including approvals obtained, promoter details, possession date, and much more. RERA registration provides transparency regarding the project’s completion timelines, amenities promised, and other crucial details.

2. Decide Between Under Construction vs Ready to Move in Property

Under-construction properties can be less expensive initially and offer the potential for appreciation as the project progresses. However, they come with risks like delays in completion and fluctuations in market conditions. Ready-to-move properties, on the other hand, allow you to see exactly what you are buying and avoid the wait and uncertainty associated with construction, making them a safer but potentially more expensive choice. Assess your immediate housing needs, financial stability, and risk appetite before making a decision. Check out this under-construction home buying guide if you decide to purchase an under-construction property.

3. Determine Your Home-Buying Budget

Before you start looking for a property, it’s important to know how much you can afford to spend. Consider not only the price of the home but also additional costs such as stamp duty, GST on flat purchase, registration fees, and maintenance expenses. Setting a clear budget will help narrow your search.

4. Understand the Loan Options

Research different home loan options and lenders to find the best interest rates and terms. Consider other factors like loan tenure, processing fees, prepayment penalties, etc. Look for a pre-approved home loan as it can give you a better idea of your spending limit and strengthen your position during negotiations. If you’re buying an under-construction property, there are also construction-linked payment plans in place to ease the burden. In simple words, you make the payment as per the stage of construction.

If you will be opting for a home loan, it is important to understand the concept of loan-to-value-ration (LTV). The Reserve Bank of India (RBI) has mandated some guidelines for the LTV2:

• If the loan amount is INR 30L or less, you can receive home loan approval upto 90% of the property value.

• If the home loan amount is between 30L and 75L, 80% of the value of property can be provided as a loan.

• If the home loan is above 75L, the expected LTV can be 75%.

5. Decide the location

Location is crucial and influences both the current price and future appreciation of the property. Consider factors like connectivity, infrastructure, safety, and proximity to schools, hospitals, and workplaces. A well-located home can provide a more convenient lifestyle and better resale value in the future.

6. Save for Downpayment

Downpayment is a crucial part of homebuying process. Start saving for it early as a larger down payment reduces the loan amount, lowering your monthly EMIs and interest over time. A downpayment is typically 10-20% of the property’s total value. Sometimes, even bank loans do not fund the downpayment. Hence, it is recommended to set a clear savings goal that eases your financial burden.

Conclusion

While buying a home for the first time is overwhelming, it is after all also a significant milestone that comes with numerous financial benefits, from tax deductions to government schemes offering subsidies. By understanding these advantages of first-time real estate investment in India and following essential tips, such as budgeting, checking RERA details, and saving for a down payment, you can confidently navigate the home-buying process.

The ongoing infrastructure projects in Mumbai, including the ambitious Third Mumbai project, Mumbai metro and the upcoming Navi Mumbai airport promise a more prosperous and bright future. This transformative development will enhance connectivity and quality of life, making Mumbai an even more attractive destination for investors and homeowners alike.