Step-by-Step Guide to Pay Property Tax Online in Mumbai

Last Updated on, July 15th, 2024

In Mumbai, property owners have to pay an annual recurring fee called property tax to the Municipal Corporation of Greater Mumbai (MCGM). This payment can be processed through offline or online channels. The Brihanmumbai Municipal Corporation (BMC) oversees the collection of Mumbai’s MCGM property tax.

What Is MCGM Property Tax?

MCGM or BMC property tax is a tax imposed on the property owners in the MMR region. The property tax to be paid depends on the value of the property.

The property tax collected is used to fund public activities like road maintenance, water supply, street lighting and many other such activities.

Every year, the due date for payment of Property Tax to BMC is 30th June. If the property tax is not paid by that date, a 2% penalty is levied.

Step-by-Step Process to Pay Property Tax Online

Step 1 – Visit BMC Portal

The Brihanmumbai Municipal Corporation (BMC) collects the property tax in Mumbai. You need to get yourself registered on the BMC portal. Visit the BMC website or the Citizen’s Corner and click on “Property tax”.

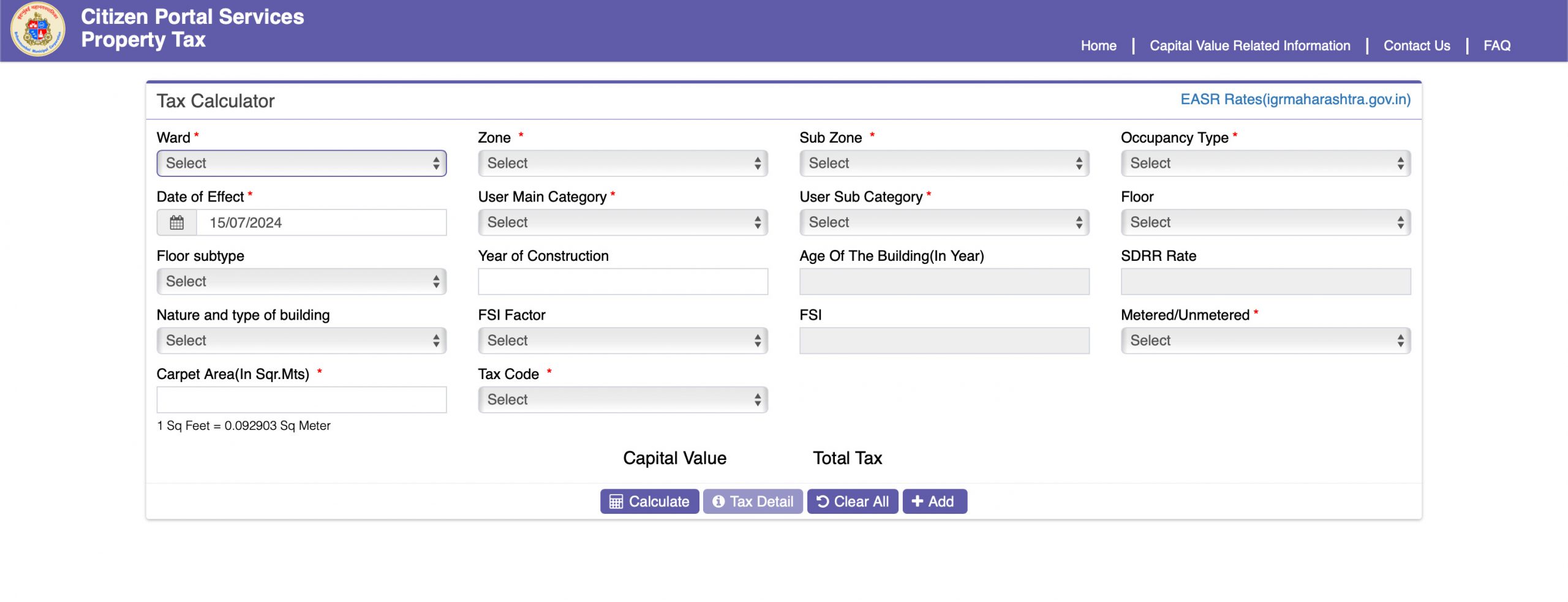

Step 2 – Calculate Property Tax

BMC provides an online tax calculator that displays the amount you need to pay. Click here to visit the MCGM tax portal. Enter all the required details and click on the Calculate Tax button.

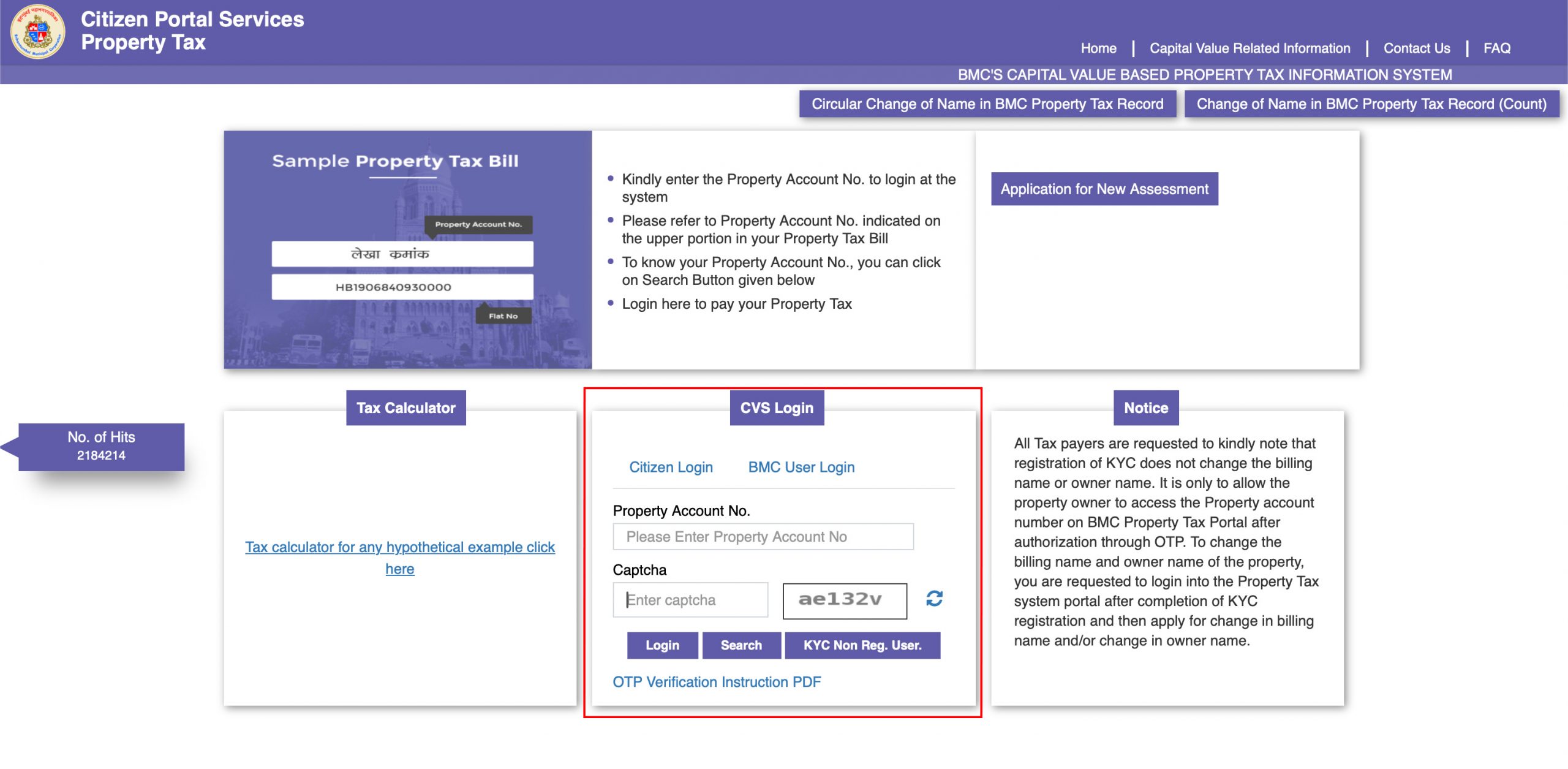

Step 3 – Login to your account

In the citizen login section, log in using the property account number and enter the captchas code.

Step 4 – Generate Bill

Click on the “Generate Bill” button. You will be able to see the property details on the screen. Verify the details and enter the amount to be paid.

Step 5 – Property Tax Payment

The payment has to be done through UPI, net banking, credit card or debit card. Once the payment is made, you will receive a confirmation from BMC.

Step 6 – Download the Tax Receipt

Download the tax receipt from the portal so that it can be used for your future reference.

While paying property tax online, you may have to enter your Property account number. To find that, select the property tax option on the home page and use the search option along with the ward number, billing name and address. This will help you locate your property account number.

Benefits of Paying Property Tax Online

• Convenience – Pay property taxes from any time and anywhere without the need to visit a municipal office.

• Secured Transactions – The payment gateways are highly secured. All your personal information is protected.

• Instant Confirmation – You receive an acknowledgement and confirmation of payment through email or SMS, reducing the risk of errors or delays.

• Time-Saving – Avoid long queues and reduce the time spent on completing the payment process.

How to Pay Property Tax Offline?

To pay the property tax offline, you can visit the nearest Assistant Revenue Office, BMC facility or any of the ward offices. The payment can be made through demand draft, cheque, cash or UPI.

Formula to Calculate Property Tax in Mumbai

Property tax is usually charged as a percentage of the capital value of the property.

Here’s the formula to calculate property tax –

Property tax = Tax rate X capital value

The capital value of the property depends on several factors.

Capital Value = Base value X total carpet area of land X building type X age factor X usage factor X floor factor

– Base value depends on ready reckoner rate of that particular area

– Building type means whether the building is residential or commercial

– Age factor refers to the period since construction

– Floor factor refers to the floor on which the property is located

Property Tax Exemption in Mumbai

The following properties are exempted from paying property tax in Mumbai:

– Properties measuring less than 500 sq ft

– Properties utilised for charity and public worship

– 60% concession to properties measuring between 500 to 700 sq ft.

– Properties used for public purposes like temples or charity trusts are also exempt from tax payment.

Conclusion

The real estate industry is evolving positively, with technology simplifying various tasks that once consumed valuable time. Whether you wish to check RERA details online or pay TDS online on property purchases, these processes have significantly improved, making them more efficient and user-friendly.

Paying property taxes online is another step in the right direction. It not only saves time and effort but also ensures secured transactions.