Epic Homes. Incredible Prices.

Epic Homes. Incredible Prices.

GST Proof Pricing

Own a stunning home at Nexworld without worrying about increased tax rates. We are offering a limited number of premium homes at Marathon Nexworld with GST proof pricing. Hurry up and book now!

Premium 1 & 2 BHK apartments starting only Rs. 33 lacs all inclusive.

Enquire Now

Offer on limited number of units only.

Epic Homes. Incredible Prices

GST Proof Pricing

Own a stunning home at Nexworld without worrying about increased tax rates. We are offering a limited number of premium homes at Marathon Nexworld with GST proof pricing. Hurry up and book now!

Premium 1 & 2 BHK apartments starting only Rs. 32 lacs all inclusive.

Enquire Now

Offer on limited number of units only.

Marathon Nexworld

A revolutionary mega township in Dombivli. Stunning skyscrapers, huge windows, epic views and floor plans that make so much sense – these are homes like you’ve never seen before.

What impact does GST have on under-construction property prices?

The Goods and Services Tax will replace Service Tax and VAT for property purchase. The GST rate on agreement value is 12%, whereas the earlier rate of Service Tax and VAT (4.5% and 1% respectively) was 5.5%. This amounts to a 6.5% increase in the overall tax rate.

While GST brings a range of other benefits like a unified and simpler tax code for customers, and input tax credits for developers which will correct prices in the longer term, in the short term it results in a higher tax rate.

To offset the increase in overall tax rate, we are offering a price protection on a limited number of units.

What impact does GST have on under-construction property prices?

The Goods and Services Tax will replace Service Tax and VAT for property purchase. The GST rate on agreement value is 12%, whereas the earlier rate of Service Tax and VAT (4.5% and 1% respectively) was 5.5%. This amounts to a 6.5% increase in the overall tax rate.

While GST brings a range of other benefits like a unified and simpler tax code for customers, and input tax credits for developers which will correct prices in the longer term, in the short term it results in a higher tax rate.

To offset the increase in overall tax rate, we are offering a price protection on a limited number of units.

What impact does GST have on under-construction property prices?

The Goods and Services Tax will replace Service Tax and VAT for property purchase. The GST rate on agreement value is 12%, whereas the earlier rate of Service Tax and VAT (4.5% and 1% respectively) was 5.5%. This amounts to a 6.5% increase in the overall tax rate.

While GST brings a range of other benefits like a unified and simpler tax code for customers, and input tax credits for developers which will correct prices in the longer term, in the short term it results in a higher tax rate.

To offset the increase in overall tax rate, we are offering a price protection on a limited number of units.

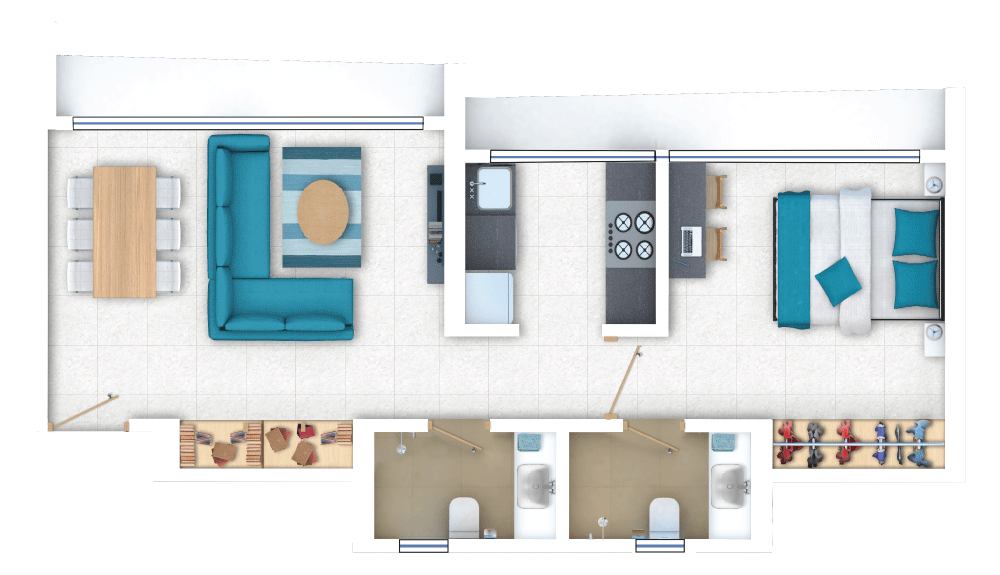

Find your perfect home

Nexworld offers three incredibly designed apartment types across a wide range of prices each with unique design variations that give you unmatched choice

1 BHK Studio

Incredibly designed and easy on the pocket. Great for nuclear families and first time home buyers

332 – 347 sq.ft. starting Rs. 33 lacs

1 BHK Premium

Stunning premium homes with our signature wide living room.

431 – 461 sq.ft. starting Rs. 42 lacs

2 BHK

Wide living rooms, L-shaped windows and a great children’s bedroom. Our 2 BHK has it all.

605 – 640 sq.ft. starting Rs. 56.8 lacs

*prices mentioned are agreement value only. Taxes and other premium charges will be applicable.

Get in touch for a detailed quote

Our sales team will help you check your loan eligibility and share the best flexible payment scheme to fit your requirement and budget. Don’t worry our pricing is transparent and easy to understand.

Get in touch

We’re happy to help.

t: 022 67248599 / 022 67728499

e: [email protected]

Site Address

Gavdevi Road, Betwade Gaon, Off Diva-Manpada Road

Dombivli East, Maharashtra 400612

Enquire Now

We’ll get back to you at the earliest.